Excel or Budget Management Software?

We have several ways to track and control personal expenses, family budget or business budget. One option is to check from time to time the various websites of our banks and credit cards. Another option is to use an Excel table to aggregate and track the expenses and revenues and to make sure that we meet the budget we set for ourselves.

Excel is a very flexible tool. In fact, the method of calculating the budget in financial management software

Geltbox Money

was originally created in Excel. Despite the existence of dedicated software, there are cases in which Excel tables can be a satisfactory solution. Therefore, we will explain how to build an Excel table to manage a budget, what are the advantages and disadvantages of each stage, and to whom it might be appropriate.

How to Build Excel Sheets to Manage Expenses, Revenue and Budget

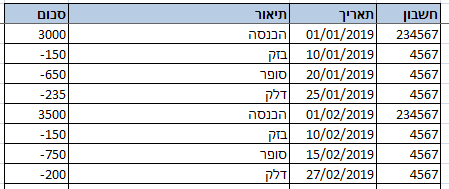

Insert data into Excel

First, we will add to the Excel spreadsheet all the transactions that were carried out over a period of time in order to calculate the total revenues and the total expenses. The manual insertion of data into Excel is usually suitable for a small number of transactions or payments made in cash.

You can also copy paste the transactions or add a link to the spreadsheet to an external file, such as a bank or credit card statement. The disadvantage of this method is that often the format of the tables from credit cards or banks changes which leads to a waste of time, especially when you need to match columns or the dates and numbers formats . Also, we have to make sure that we have not forgotten rows or added duplicate rows while copying the data. This method can be tedious if we import data from multiple accounts and cards on a weekly or monthly basis.

Classification of expenses and revenues in Excel

After adding the data, we have to separate expenses, income, and movements that we do not want to take into account, such as transfers between our different accounts. This can be done by entering expenses and income in two separate tables or by adding a column called "Calculate As".

Usually it is not enough to know the total monthly expenses. We are interested in segmenting and analyzing expenditures by categories or sections that we define. This can be achieved by adding a column named "Category".

If we have a large number of transactions we would like the category to be filled automatically to save us time, especially in repetitive transactions and when it comes to many transactions. You can use the Excel VLOOKUP function to search for previous classifications and display them as another column called "Recommended category". There may be problems finding previous movements in cases where the description changes even slightly.

Summary of expenses versus income in Excel

Now that we have achieved our goal of building a summary table of expenses and income by categories in Excel, it is relatively easy to display the results in a bar graph or pie. It's usually useful to compare monthly spending levels during the year to identify trends.

Benefits of using Geltbox Money instead of Excel

- Simple data import:

The software allows automatic import from sites or files and makes sure to match the various formats of data.

- Categorization of Transactions:

Geltbox will learn your labeling habits and will automatically categorize the transactions after each import. In addition, you can label transactions in secondary categories, and separate transactions between portfolios (for example, between personal and business portfolios).

- Summary and Graphs:

The software allows us to easily display an expense graph against monthly revenues and a graph for each category separately. This makes it possible to analyze each type of expense separately and identify trends. In Excel, however, different graphs are required for each period and it is necessary to ensure that changes in the spreadsheet are reflected in the graphs.

- budget:

Setting a budget makes it possible to leave money for savings or cash flow flexibility. In the software we can set budgets and receive alerts accordingly. In Excel we can add a budget column in the expenses and income summary table. The advantage of the software is that we can easily add sub-categories to any category and assign them budgets separately.

Using both Excel and Geltbox Money, export to Excel

On occasions we would like to make extra calculations in Excel but to benefit from the automatic import of the software. In this situation, it is possible, from time to time, to export the data from the software to an Excel file and to use it in the Excel spreadsheet by reference to the file (recommended) or by copying the data.

In conclusion

In this article we reviewed the possibility of using an Excel file to manage budget, expenses and income. We also noted that adding data into an Excel spreadsheet can be a challenge especially when we have multiple bank accounts and credit cards. Even if Excel is used, software like Geltbox Money can help automatically import data, categorizing and understanding information.

- Example Excel file for budget management-

Download xlsx

- Geltbox Money software -

Home